Long Term Capital Gains Tax Rate 2025 Usa. The rate of tax is 10 percent without. In 2026, these limits are set to decrease.

In 2025, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million (twice that for couples making joint gifts).

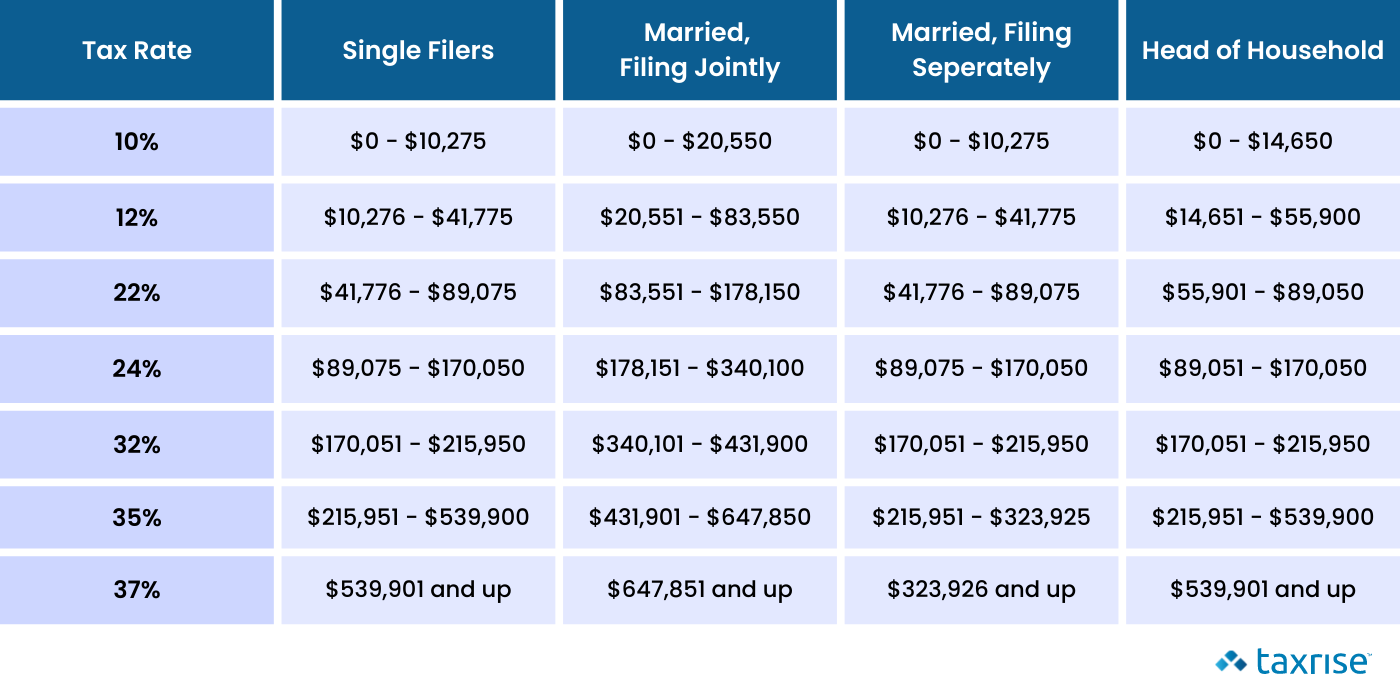

Tax Tables 2025 Irs For Capital Gains Vanda Miranda, It is imperative to grasp the prevailing tax rates to optimize tax efficiency and maximize investment returns. Single tax filers can benefit from the zero percent capital.

Tax Rate For Capital Gains 2025 Hildy Latisha, In 2025, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million (twice that for couples making joint gifts). The rate of tax is 10 percent without.

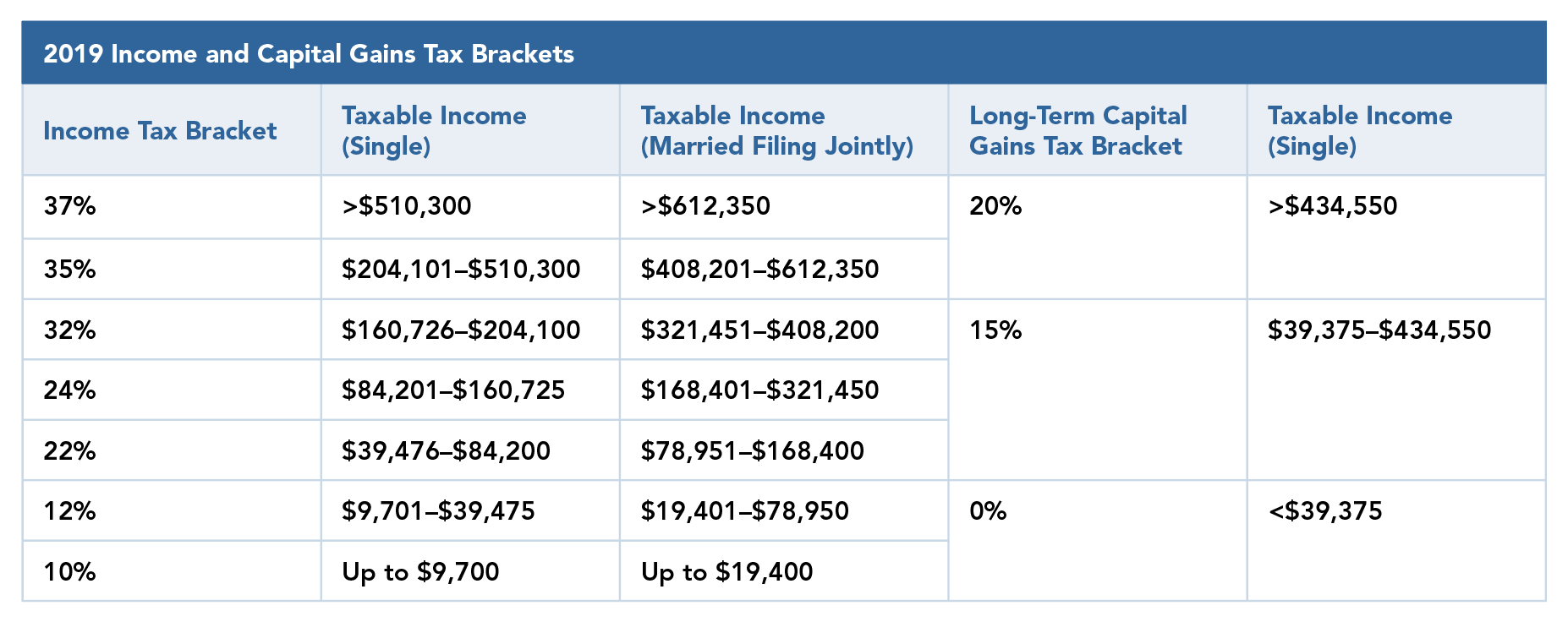

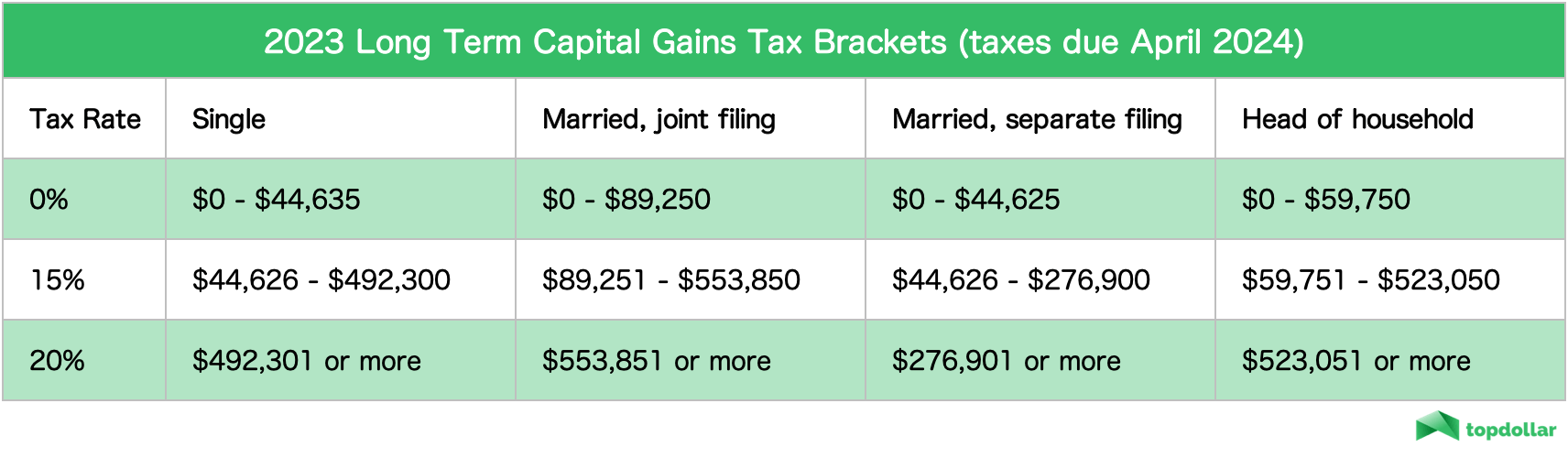

LongTerm Capital Gains Tax Rates For 2025 Dacy Michel, In 2025, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million (twice that for couples making joint gifts). The rates are 0%, 15% or 20%, depending on your taxable income and filing status.

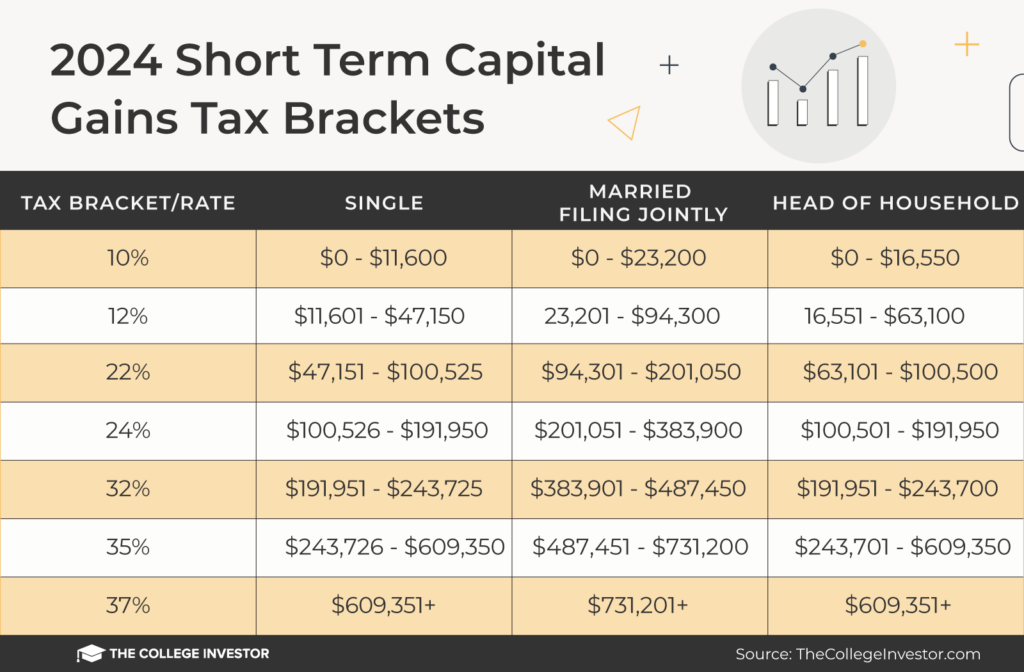

ShortTerm And LongTerm Capital Gains Tax Rates By The News Intel, Single tax filers can benefit from the zero percent capital. The rate may be lower than what you pay on your.

Capital Gain Tax Rate 2025 California Geri Sondra, Here’s a look at the rates at which qualified dividends are taxed in 2025 and 2025. The rates are 0%, 15% or 20%, depending on your taxable income and filing status.

ShortTerm And LongTerm Capital Gains Tax Rates By, Remember, this isn't for the tax return you file in 2025, but rather, any gains you incur from january 1, 2025 to december 31, 2025. Unemployment rate rises to 4.1% from 4.0%.

Cryptocurrency Taxes A Complete Tax Guide For All Cryptocurrencies For, You'll file this tax return in 2025. In 2026, these limits are set to decrease.

الأبجدية سرعه انخفاض short term capital gains rate, The rate may be lower than what you pay on your. There are only three rates:

What Is The Capital Gains Tax Rate For 2025 2025 CGR, In 2025, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million (twice that for couples making joint gifts). The rate may be lower than what you pay on your.

Long Term Capital Gains Tax Rate 2025 Usa Celia Darelle, The rate may be lower than what you pay on your. These rates tend to be significantly lower than the ordinary income tax rate.

It is imperative to grasp the prevailing tax rates to optimize tax efficiency and maximize investment returns.