Retroactive Tax Credits 2025 Calculator Program – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . and some allow you to deduct student loan interest and/or take education credits. Here are our picks for the Best Tax Software of 2025. Free option available for federal filing, includes state .

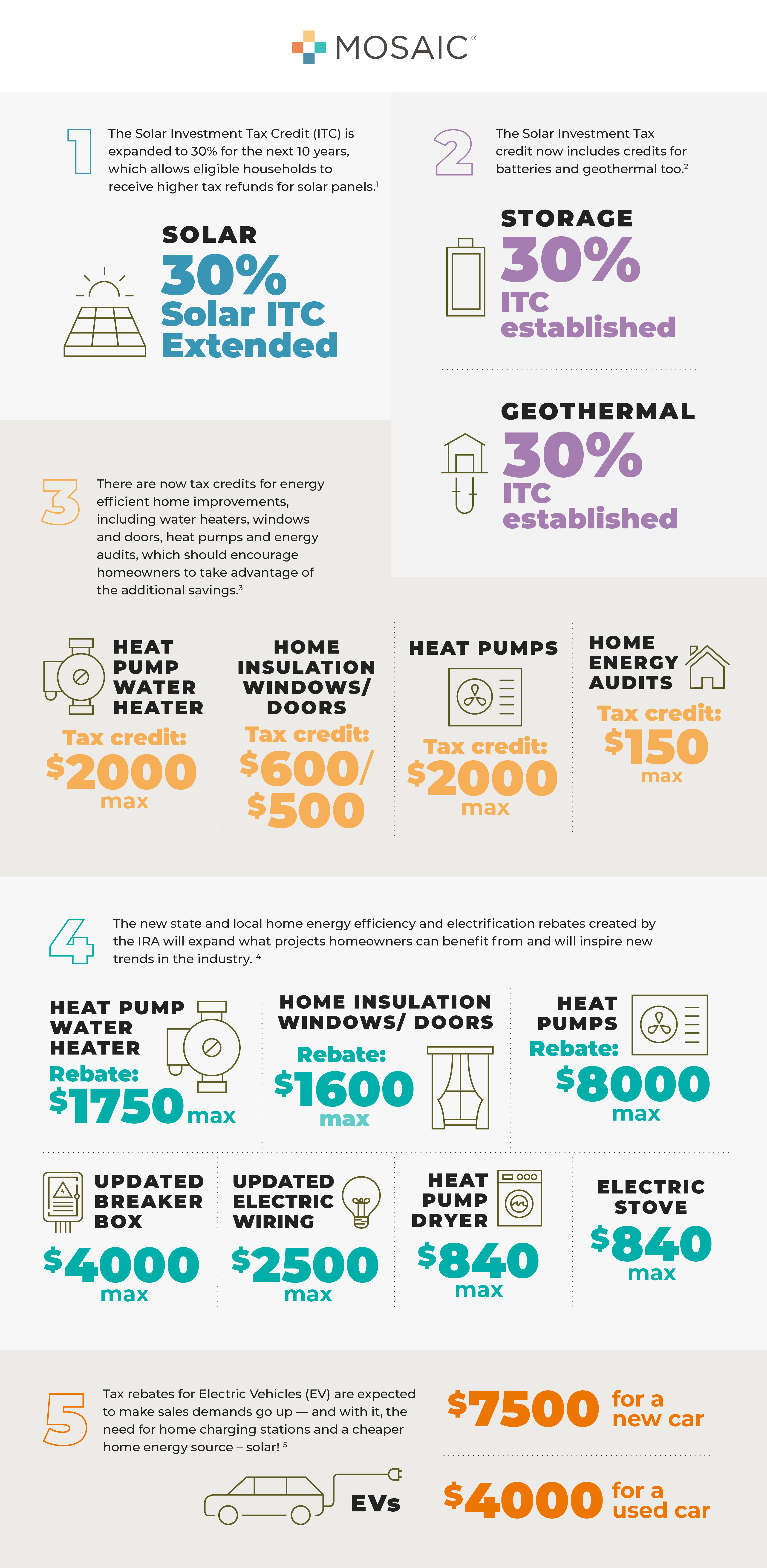

Retroactive Tax Credits 2025 Calculator Program Who gets a break? Clashing ideas on tax relief are teed up for the : A new tax bill aims to increase access to the child tax credit for lower-earning families — but it’s much less generous than it was in 2025. . here to confirm its current eligibility in the program. On the plus side, for 2025 the incentive has been switched from a one-time tax credit that’s claimed in the following tax year .