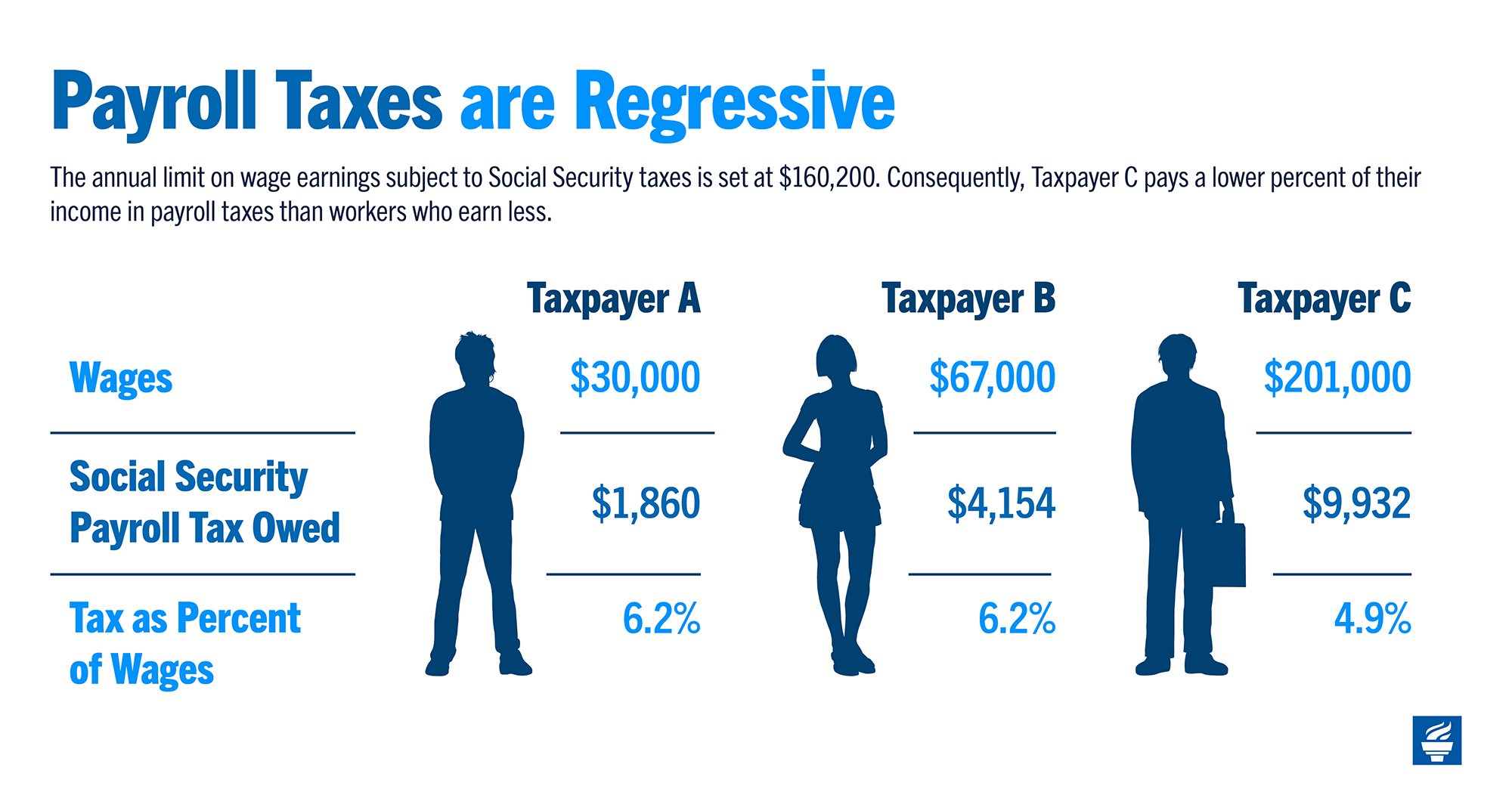

Social Security Limit 2025. Here are five important ways social security will be different in 2025. In 2025, this limit rises to $168,600, up from the 2025 limit of $160,200.

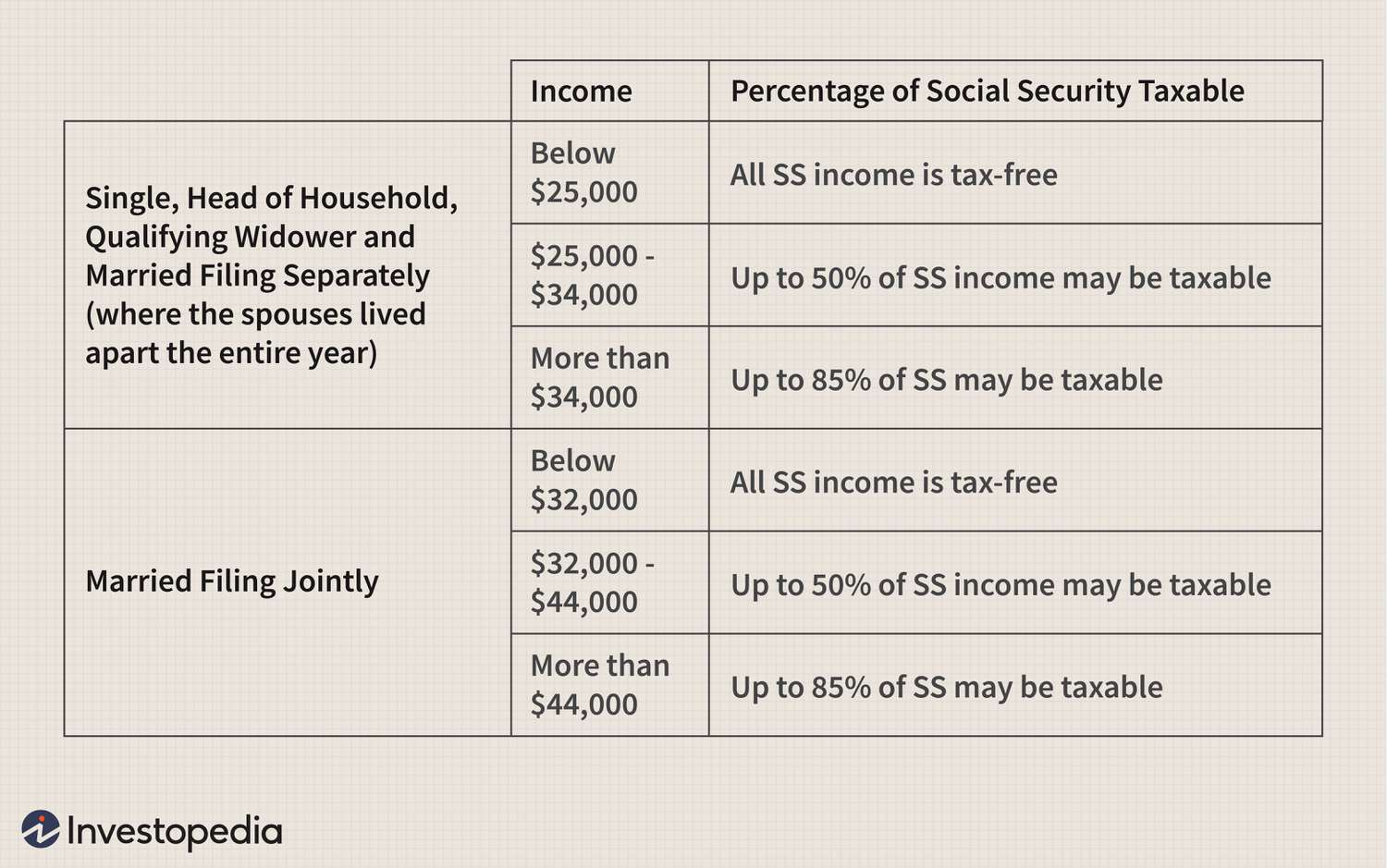

You file a federal tax return as an individual and your combined income is between $25,000 and $34,000. The earnings limit for people reaching their “full” retirement age in 2025 will increase to $59,520.

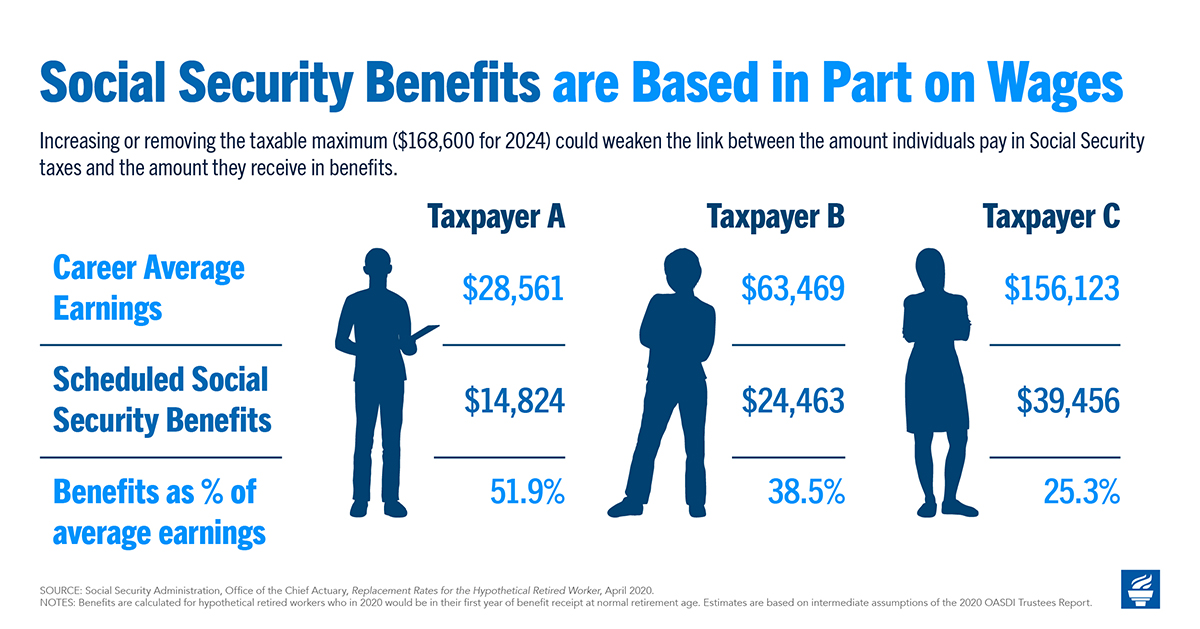

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons, Potentially lost in the excitement of the 2025 cola. By law, some numbers change automatically each year to keep up with.

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons, We call this annual limit the contribution and benefit base. Here are five important ways social security will be different in 2025.

Social Security Limit for 2025 Social Security Genius, But beyond that point, you'll have $1 in benefits withheld per $2 of. Those limits change from year to year, but in 2025, the base limit is $22,320, up from $21,240 in 2025.

Maximize Your Paycheck Understanding FICA Tax in 2025, However, if you retire at. For 2025, the social security tax limit is $168,600 (up from.

How do i calculate my taxable social security benefits 2025 The Tech, This update provides information about social security taxes, benefits, and costs for 2025. Potentially lost in the excitement of the 2025 cola.

Are My Social Security Benefits Taxable Calculator, We call this annual limit the contribution and benefit base. You file a federal tax return as an individual and your combined income is between $25,000 and $34,000.

2025 Ssdi Limits W2023B, The highest social security retirement benefit for an individual starting benefits in 2025 is $4,873 per month, according to the social security administration. As a result, in 2025.

The Social Security tax limit for 2025 and how it works explained The, Potentially lost in the excitement of the 2025 cola. Refer to what's new in publication 15 for the current wage limit for social security wages.

Social Security Limit 2025 See Full Details and Additional Benefits, Beyond that, you'll have $1 in social security withheld for every $2. Here are five important ways social security will be different in 2025.

Social security wep calculator JensonFowzan, As a result, in 2025. The maximum social security employer contribution will.

Those limits change from year to year, but in 2025, the base limit is $22,320, up from $21,240 in 2025.